- Net fair value change and reversal of tax provisions lifted FY25 earnings, offsetting lower residential contributions due to timing of projects

- Proposed dividend of 4.5 Singapore cents per share

- Three pillars to drive sustainable value creation – increasing development exposure over the medium to long-term, driving recurring income via active portfolio and asset management, as weil as capital efficiency

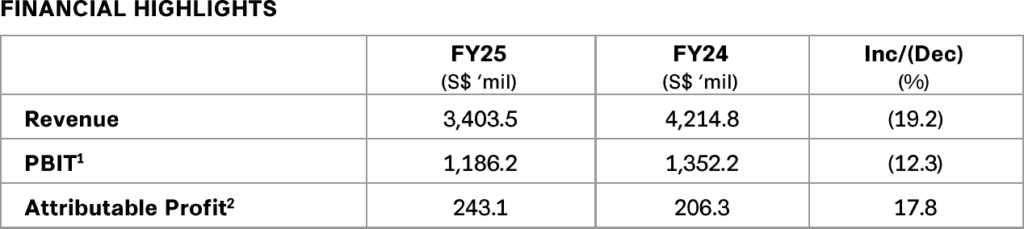

Frasers Property Limited today announced its financial results for its full year ended 30 September 2025 („FY25“).

Mr Panote Sirivadhanabhakdi, Group Chief Executive Officer of Frasers Property, commented, „We remain on strategy, guided by our integrated investor-developer-operator model that enables us to adapt and execute across cycles. Our long-term priorities – including portfolio rebalancing and capital efficiency – continue to shape a future-ready business that aims to deliver enduring value for all stakeholders. FY25 performance reflected ongoing macroeconomic headwinds and the inherent lumpiness of residential contributions. Even so, our resilient recurring income base and net fair value change supported earnings. We recognise the challenges ahead. We are taking disciplined steps to strengthen performance and protect value, with a clear focus on delivering near-term outcomes, while staying committed to our long-term goals.“

The Group’s FY25 earnings benefited from net fair value change recorded from build-to-core development completions and divestments, along with reversal of tax provisions. However, PBIT declined due to lower residential contributions across most markets, primarily due to timing of project settlements and impairments on certain projects, partly offset by strenger industrial and logistics („l&L“) and retail performance. Excluding the one-off reversal of tax provisions, attributable profit was 50% lower year-on-year, reflecting lower PBIT and higher net interest expense.

Net asset value per share as at 30 September 2025 was lower at $2.37 (30 September 2024: $2.45). The strengthening of the Singapore dollar, particularly against the Australia dollar, resulted in unrealised net foreign currency translation reserve loss. The Group’s net debt3 to property assets ratio as at 30 September 2025 stood at 43.7% (30 September 2024: 42.1%), while net debt to total equity4 ratio rose to 89.2% (30 September 2024: 83.4%). The higher net debt was mainly due to funding for the privatisation of Frasers Hospitality Trust (FHT), acquisitions by the Group’s consolidated REITs, as weil as capital expenditure. Approximately 75.0% of the Group’s total debt was either on fixed rates or hedged, with a weighted average debt maturity of 2.5 years and blended cost of debt of 4.0% per annum.

Taking into consideration the Group’s financial performance and cash flow requirements, Frasers Property’s Board of Directors has proposed a first and final dividend of 4.5 Singapore cents per share for FY25, maintaining the same level of 4.5 Singapore cents per share paid for FY24.

Quelle: Frasers Property Limited

Bildquelle: Jürgen Nobel